Learning how to build credit takes time and patience, whether you’re starting from the ground up or are looking to improve your score.

Even for the most financially literate, it can be difficult to understand how to build credit the right way. It takes time to build good credit, but putting in the work now may open up better financial opportunities in the future.

Whether you need to establish a credit score from the ground up, are wondering how to improve your existing score or just need credit help, you can use this guide and its information about credit reporting agencies to help you reach your financial goals.

Table of contents

- How to build credit from scratch

- How to continue building credit

- How is a credit score calculated?

How to build credit from scratch

If you’re brand new to the world of credit, you’ll need to go back to the basics of credit building. The first step in obtaining a credit score is to establish a credit lending or borrowing history. If you’re starting out without any lending history or an insufficient credit history, there are various lending options for you.

Read on for ways you can start building credit from the ground up.

1. Apply for a credit card

Credit cards are an excellent place to start building credit, as payments are reported automatically to credit agencies. There are a number of credit cards that exist just for beginners and those looking to build their credit from the ground up. Here are the ones we recommend.

Secured credit cards

A secured credit card helps you build a credit history without any of the risks that typically come with borrowing a large sum of money. Secured credit cards will use a deposited sum of money (almost like a security deposit) to act as collateral for a line of credit, with most secured cards requiring a deposit of at least $200.

Depending on the credit card issuer, there may be an additional annual fee.

It’s incredibly important to pay off your balance on time, because secured credit cards often have a high purchase annual percentage rate (APR) for overdue amounts. It’s highly recommended that you use a secured credit card as you would a debit card: make purchases only when you know you have the money necessary to pay for them.

Student credit cards

Student credit cards are designed for college students age 18 or older. Student credit cards may require a minimum credit score in order to apply, but many requirements of these cards are designed to fit the needs of an average student.

With low interest rates and APRs and competitive rewards programs, these cards can help build credit if you’re just starting out.

Store credit cards

Store credit cards are an option that many businesses offer to finance purchases, made both in-store and online. Many store credit cards have a low or no credit score requirement, which makes them a great option for consumers starting out without credit. Store credit cards are best used for grocers and any other place where you shop frequently for necessities.

2. Report rent and utilities

Rent and utilities are not usually reported to credit agencies because landlords and leasing companies often don’t bother reporting this activity. However, timely rent and utility payments are an excellent opportunity to begin building credit, as they prove to lenders that you’re capable of making large monthly payments on time.

To begin reporting your monthly rent and utility payments, ask your landlord if they have an option to report your payments to credit agencies. If you live in a larger complex with a leasing company, see if they have a credit reporting option on your rent payment website and opt in to report payments each month.

3. Take out a credit builder loan

Credit builder loans are a safe option for new borrowers to establish some credit history easily. If this sounds like an appealing option to you, consider looking at banks, credit unions and self-lending companies. They offer small-scale loans as a way to kick off your credit-building history—typically in amounts of around $1,000.

You’ll be expected to pay back the loan over a period of six to 12 months. During the term of your loan, you will need to make payments on time in order to earn a positive credit score.

4. Negotiate a loan

Any loan will count toward your credit score, so if you’re planning on a large purchase or have a big expense coming up, you may want to consider negotiating a loan. If you’re starting without credit, a lender could ask you to either provide collateral or have a loan cosigner.

To make loan terms more favorable, consider negotiating for things like a lower interest rate, loan consolidation or even debt forgiveness—depending on your situation.

5. Consider a cosigner

A cosigner for a credit card acts as the final person responsible for the debt, promising that if any funds are due, they’ll make sure the money is paid by either themselves or the primary cardholder. It’s normal for people to have cosigners for student and car loans, as these are often hefty investments made by younger borrowers who may not have much credit history.

A cosigner can be used when applying for a credit card if you:

- Do not have sufficient funds to maintain credit card payments alone

- Are under the age of 21

- Do not have a credit history

Ask a parent or guardian if they are comfortable becoming your credit card cosigner. Note that they should have a strong credit score and a good borrowing history to indicate that you can count on them to have your back if needed. Keep in mind that any payments you miss or pay late can decrease not only your score, but your cosigner’s as well.

How to continue building credit

Once you’ve opened up a credit card or two and your credit score is on the way up, you may think you no longer need to worry about building credit. However, working on your credit is not a one-and-done deal—it takes constant work to ensure you’re following credit best practices to build the credit you’re proud of.

Below are five ways you can continue building your credit up and to the right.

6. Become an authorized user on someone else’s card

As an authorized user, your name will begin to show on the credit history for someone else’s credit card account. In turn, you will be building credit. An authorized user is different from a cosigner in that authorized users aren’t fully accountable for repaying debts, but you should still be asking a trusted friend or family member, as a debt going unpaid can adversely affect your credit.

Make sure to first check that the card provider in question reports authorized user statuses and other information to the credit bureaus, because not all do.

7. Pay off your credit more often

Paying off your credit more frequently than the required monthly payment can affect your credit score in a positive way, as it will stop you from falling further into debt and help keep your credit utilization low.

Paying your bill more frequently also means a higher number of total payments to influence your credit. Paying your bill not just on time but more often is a longer-term investment that will have a positive effect on your credit score.

8. Request a credit limit increase

If your credit limit seems to be looming closer and closer each month, you may want to consider asking your credit card lender to raise your limit. When you first make your request, be sure to have first paid off any outstanding balances or bills due on the card.

Credit card companies will investigate your account before deciding whether to raise your credit limit. Keep in mind they can deny a credit increase request if you have outstanding balances, frequently miss payments or pay only the minimum balance more often than not.

9. Check your credit score and reports

Checking your credit score and reports on a frequent basis can help you for multiple reasons. Firstly, you can see which credit behaviors are helping your score, and which may be hurting it. When you check your credit score each month, try and see any trends—for instance, if you paid off a credit card in full, you may notice your score dip, or if you made multiple payments on your card, you may notice it increase.

Secondly, being vigilant when checking your credit report can help you spot any incorrectly reported items or fraud that you can petition to be taken off of your credit report. You’re able to get one copy of your credit report each month from each of the three major credit reporting agencies—Equifax®, Experian® and TransUnion®. You can request your report directly through these agencies or through sites like AnnualCreditReport.com.

10. Remove certain negative credit entries

Negative items are entries on your credit reports that typically have a negative effect on your credit, like hard inquiries, late payments or bankruptcies. Negative items can potentially be removed from your credit reports if they are inaccurate, unverified or unsubstantiated. In the case that a negative item is removed, it’s likely that your credit will be affected positively.

To remove an inaccurate or unverified negative item, you’ll need to submit a dispute letter outlining the discrepancies you found. This letter is then submitted to credit agencies, requesting that they either correct or remove the inaccuracy. If you prefer not to handle this process yourself, a credit repair company like Score Revive can help.

How is a credit score calculated?

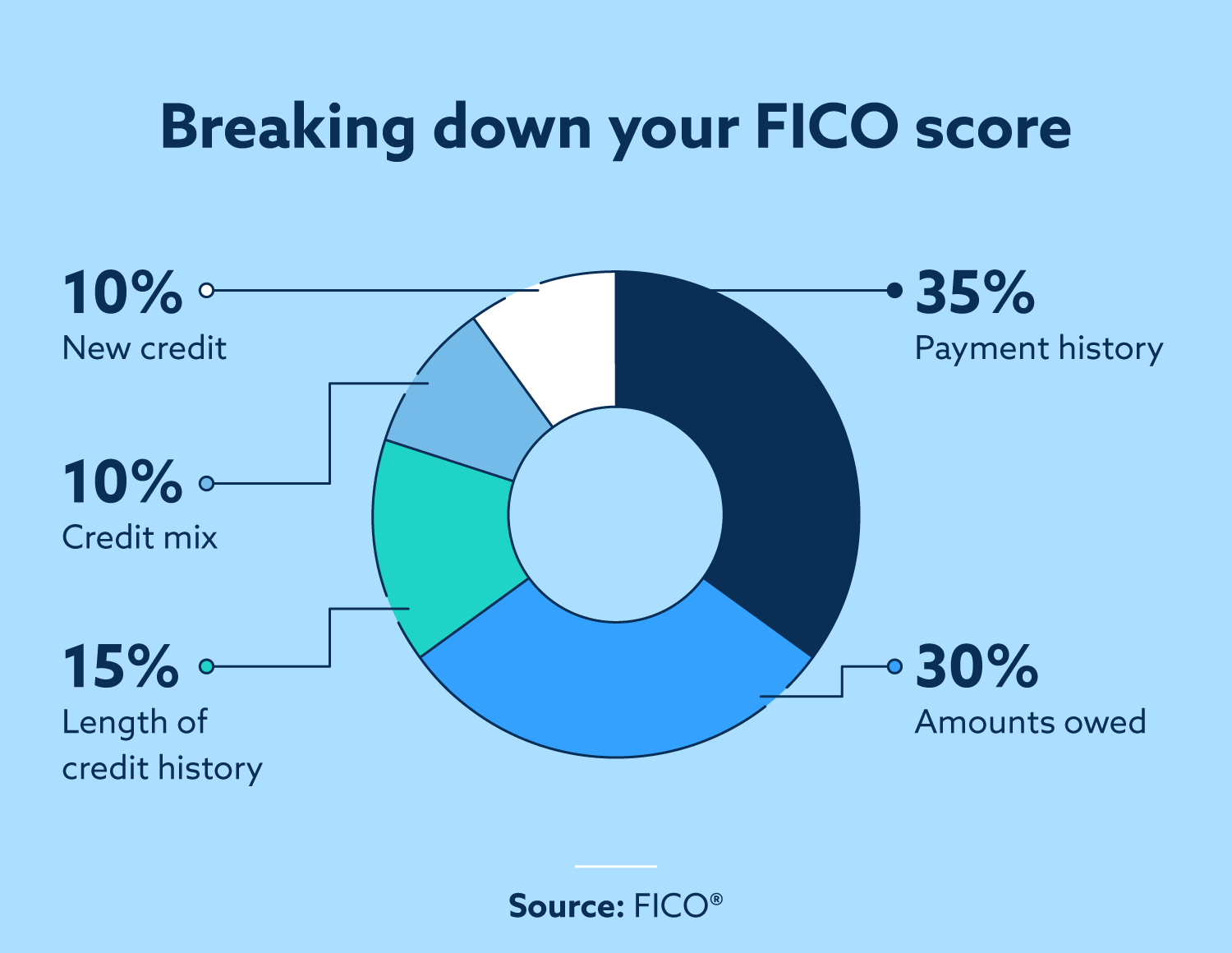

To best understand how to build or improve upon your credit score, it’s important to look at how your credit score is calculated. Your FICO® score is determined using data reported by the three major credit bureaus, and that data is then used by lenders to gauge your borrowing risk and eligibility.

The FICO score factors:

- Payment history

- Amounts owed

- Length of credit history

- Credit mix

- New credit accounts

Payment history

Payment history is the most important factor, carrying a 35 percent weight in your overall credit score. It will have a positive effect on your credit score if you make your payments on time, but payment history will have a negative effect on your credit score if you carry over balances, make late payments or default on payments.

Amounts owed

Amounts owed, which looks at both your total debt amounts and your credit utilization ratio, makes up 30 percent of your credit score. Your credit utilization ratio is determined by comparing how much credit you’re using to how much credit you have available to you.

Just because you have an outstanding debt doesn’t mean you’ll have a bad score. However, amounts owed can reflect negatively on your credit when you have large debts that you aren’t making the minimum payments on or when you’re frequently using a majority of the credit available to you.

Length of credit history

How long you’ve been listed as a borrower accounts for 15 percent of your overall credit score. The length of your credit history adds credibility to your credit score for lenders, as it proves you are capable of making timely payments.

A long, bad credit history will have a negative impact on your credit score, sometimes even significantly lowering your score.

Credit mix

Accounting for 10 percent of your overall score, credit mix is the diversity of your overall credit or lending history and accounts. Your credit mix is defined by the number of different types of credit you have outstanding and you have used in the past. Student loans, car loans, credit cards, mortgages and any other formal lending will be accounted for in this area.

New credit

Your new credit applications make up 10 percent of your overall credit score. This is where hard inquiries come into play—these are triggered when you apply for something, like a new credit account or an apartment lease, and the lender or other third party requests to see your credit score. You have to give your permission for these credit checks, though, so you should recognize any hard inquiries on your reports.

Fortunately, hard inquiries generally fall off credit reports after two years, and they really only carry weight for the first six to twelve months of that time period.

Now that you know how your credit score is calculated and what kinds of actions will help you work on your credit, it’s time for you to get started. Whether you’re a student just starting out on your credit journey or someone in need of credit repair, there are a number of options for building credit, like getting a cosigner or negotiating a loan. Building credit may take time, but it will help set you up for financial success in the long run.