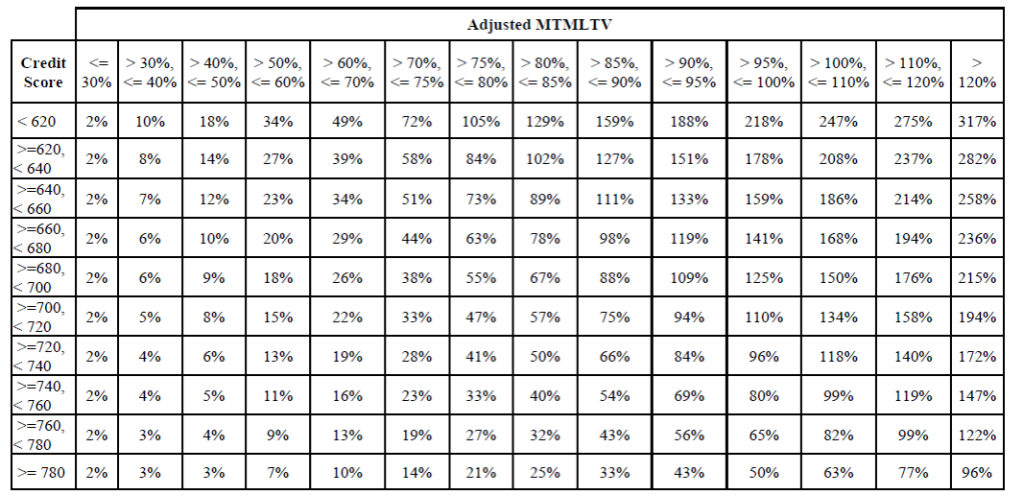

[ad_1] Potential homebuyers in today’s market are facing a number of challenges, including increasing mortgage rates and a sizeable supply and demand imbalance that is pushing home-price appreciation to very high levels throughout the country. MBA’s Purchase Application Payment Index (PAPI) has increased by 32% thus far this year, indicating that payments have risen much faster than personal income. Primary mortgage market rates are a function of several factors. First, mortgage rates are influenced by benchmark rates, including longer-term Treasuries. These rates are impacted by the strength of the economy, the level of inflation, and the expected direction of monetary policy, among other factors. Secondary market rates, yields on mortgage-backed securities, are determined by factors that influence the supply and demand of these securities. These include expected prepayment rates, expectations of net supply to the market, and drivers of net demand from different investors including banks, Fannie Mae and Freddie Mac (the GSEs), asset managers, global investors, and in recent times, the Federal Reserve. The spread between primary and secondary rates is impacted by yet another set of drivers, including the level of available capacity in the industry — which can vary significantly over the cycle; servicing values, which are impacted by market demand for MSRs, including any changes to servicing costs; and credit pricing, which includes guarantee fees, loan-level price adjustment (LLPAs), and mortgage insurance premiums (MIPs). The primary mortgage market is intensely competitive, as I highlighted in a column earlier this year. Lenders are essentially price-takers in this market. If they raise their offered rates much above the market, they will lose the business. If they lower them much below market rates, they won’t be able to cover their costs in the long run. In this column, I will walk through how FHFA, Fannie Mae and Freddie Mac determine their pricing, and why recent pricing changes to high-balance loans and second homes deserve a review for reconsideration, particularly if the Federal Housing Finance Agency (FHFA) wants the GSEs to use these products to generate sufficient funds to further subsidize loans to “core mission” borrowers. The secondary market entities face a different challenge. Fannie Mae, Freddie Mac, FHA, the U.S. Department of Veterans Affairs (VA), and the U.S. Department of Agriculture (USDA) have substantial market and pricing power. When Fannie and Freddie — through their regulator, FHFA, — decide where to set prices, or when FHA sets the MIP, they are not facing a situation of perfect competition, and hence have the ability to set prices at levels that might be different than where competitive markets would go. However, there are certainly limits to the pricing power of these agencies. While private markets, either portfolio or private-label security (PLS) executions, may not readily be able to compete for agency business, if rates are pushed too high, these alternative executions may offer a better deal for lenders and their customers, particularly for low-risk loans. On the other hand, for some parts of the business that may be higher risk, if agency pricing is too high, these borrowers may not have another place to turn. I began my career in the mortgage industry at Fannie Mae, helping to develop some of the analytical models that provided inputs into Fannie’s guarantee pricing model. While I have not been at a GSE for some time, by following FHFA’s guarantee fee report and other public information, my understanding is that the conceptual basis for credit pricing has not changed. On a fundamental basis, the credit price for a loan, the base guarantee fee and the LLPAs, should cover both the expected losses from the loan and GSE administrative costs. The GSEs earn float income for the period of time they hold principal and interest payments, which provide a small offset to these costs. However, the largest component of credit pricing is a function of the capital that each GSE needs to hold against a stress level of credit losses associated with the loan (e.g., the level of losses for that type of loan experienced during the Great Financial Crisis (GFC) as a result of large declines in home prices and a deep recession). To put numbers on it, while a certain loan might have an expected loss (in normal economic conditions) of 40 basis points (1% probability of default, 40% loss given default), in a stressful environment, that same type of loan might have a loss of 200 basis points (4% probability of default, 50% loss given default). Like an insurance company, a GSE needs to be sure it has sufficient resources to weather an appropriately severe stress event. Setting aside an appropriate amount of capital, and charging enough to earn a market rate of return on that capital, should do that. You might recall the recent debates over FHFA’s revisions to the GSE capital requirements. Market participants know that setting required capital for the GSEs too high would artificially inflate credit pricing and could reduce credit availability in the market. Setting it too low puts the GSEs at risk of another failure in the event of a severe recession or housing market crash. Beyond the top-line capital numbers, the precise calibration of required capital for different types of loans can have momentous impacts on how these products and loan-level attributes fare in the marketplace. Exhibit 1 shows the grid of capital requirements for loans with different loan-to-value (LTV) ratios and credit scores from the FHFA capital rule. Exhibit 2 shows the “multipliers” used in the rule: for a loan with any given LTV ratio and credit score, loans with these attributes are projected to have a multiple of these loss rates in stressful conditions. (As a quick example of how to read this: the base risk weight for a 720-740 credit score, 80-85% LTV ratio loan is 50%. That implies 4% capital given the 8% capital requirement. Now go to Exhibit 2 for the multipliers: A one-unit purchase loan (1.0 multiplier) for an owner-occupied home (1.0 multiplier) would require 4%