There are five major factors that impact your

FICO® credit score.

How FICO Scores Work

Your FICO score is calculated by a computer algorithm that evaluates many sources and types of information on your credit report when you apply for credit. By analyzing the information and patterns in your credit profile to patterns in millions of past credit reports, your FICO score provides lenders a consistent and reliable assessment of how risky it may be to lend you

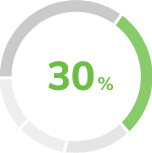

Amounts Owed reflects how much you owe each creditor individually and in total. It includes your utilization rate for revolving lines of credit (e.g. credit)

New Credit is the new account opening activity and any recent ‘hard’ credit inquiries from lenders on your credit report. Approximately 10% of a FICO® Score is based on this information.

Payment History is the most important factor in calculating your FICO® credit score. Your payment history accounts for over a third of your overall FICO credit score.

Credit Mix is the types of credit used. Examples may be revolving credit cards or revolving lines of credit, or installment credit like a fixed loan amount.