[ad_1]

Maruti Suzuki’s (MSIL)’s product pipeline has just kick-started with upgrades of key models and it is on the cusp of launching new models. While return of product lifecycle will drive market share recovery (~600bp by end-FY24E), strong demand, improving supplies and stable commodity prices will propel EBIT margin improvement of ~550bp for MSIL. The recent decline in commodity prices and favourable JPY/INR movement can add ~180bp to margins (not part of our estimates) and 17% EPS upgrade for FY24E. We maintain our Buy rating on MSIL with a TP of ~Rs 10,000 (premised on ~27x Jun’24E consol. EPS).

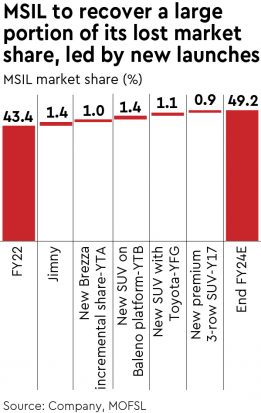

Product lifecycle has just kick-started after a gap of almost three years: MSIL’s product pipeline has just kick-started with an exciting line-up of launches over the next 2-2.5 years – PV segment’s market shares are highly correlated with product lifecycles. It has launched upgraded Celerio, and mid-cycle refresh of Baleno as well as XL6. Going forward, MSIL would be launching: new models (four SUVs), platform upgrade (Alto) and mid-cycle refresh (Brezza). Four new SUV brands are lined up for launch over the next couple of years to plug the gaps in its portfolio. Based on our channel checks, MSIL is planning to replicate its highly successful product laddering strategy in the SUV segment, thereby giving customers an option of an SUV at every price point. Based on MSIL’s launch pipeline, we estimate its market share to improve ~600bp to ~49% by end-FY24E over FY22.

Demand remains good, though supply issues crop up intermittently: Demand for PVs remains robust with healthy traction in inquiries and bookings. In the domestic market, the unfulfilled order book has increased to ~295k units as of May’22 (of which 130k was CNG) and has consistently remained above ~200k units since Q3FY21 due to healthy demand and chip shortages. MSIL has also been seeing substantial traction in exports. The semiconductor shortage has been gradually improving, though it crops up intermittently, like in Mar-Apr’22 before production recovered in May’22.

Valuation and view: Strong demand, improving chip supplies, moderating commodity inflation and favourable Fx would support margin recovery. Robust demand, coupled with strong recoveries in both market share (+600bp) and margins (+550bp) over FY22-24E, would drive 66% CAGR in EPS. The stock trades at 34.1x/22x FY23E/FY24E consolidated EPS. We maintain Buy.

[ad_2]

Source link