[ad_1]

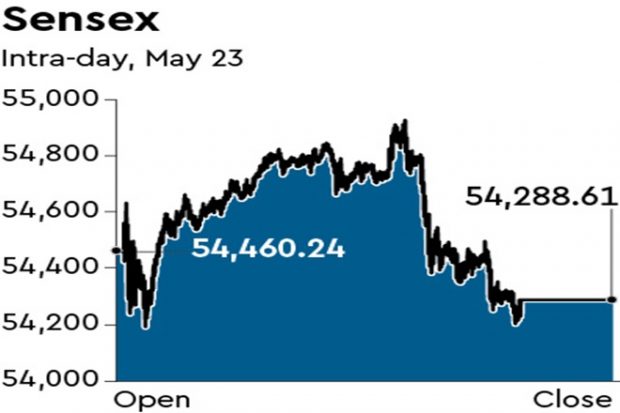

Domestic equity markets pared their initial gains on Monday to end the session in the red, as a heavy sell-off in metal stocks dampened investor sentiment. After rallying as much as 605 points in intra-day trade, the Sensex ended lower by 37.78 points at 54,288.61 on Monday and the broader Nifty-50 settled at 16,214.70, down 51.45 points or 0.3%. Among the Sensex stocks, Tata Steel was a top laggard and contributed the most to the fall as it declined 12.53% on Monday, its worst single-day fall since August 2015.

With Monday’s fall, domestic markets have fallen about 5% so far in May, posting losses in 11 out of 15 sessions of the month. The market’s fear gauge — India VIX spiked to 23.39 on Monday, a spike of more than 20% from 19.42 during April end.

In line with the headline indices, the broader markets, too, ended in the red on Monday. The BSE mid-cap ended lower by 0.3%, while the small-cap index declined 0.6%. Overall, out of the 3,577 stocks traded on the BSE, 2,048 stocks declined on Monday.

However, auto makers — M&M and Maruti Suzuki — surged over 4% on Monday, aided by the Centre’s decision to slash excise duty on petrol and diesel prices. Moreover, reduction in steel prices is being seen a big positive for consuming sectors like infrastructure and automobiles.

Shrikant Chouhan, head of equity research (retail), Kotak Securities, “After a firm start, markets failed to hold on to their early upsurge and simply lost track to end marginally lower. Metal stocks bore the brunt while, realty, and oil & gas stocks also came under selling pressure, thus dragging key indices lower.” He further added that if the Nifty index manages to end above 16,300, a fresh uptrend up to 16,475 levels can be seen.

Foreign portfolio investors (FPIs) turned net sellers again after Friday’s purchase. On Monday, overseas investors offloaded Indian equities worth $251.7 million, taking this month sales to $4.2 billion. In contrast, local investors, including mutual funds bought shares worth $186.5 million, provisional data available on exchanges showed.

Barring Nifty IT, Auto and Consumer durables, all major sectors ended in the red on Monday — with Nifty Metal being the worst performer, down 8.14% — also its worst day since March 2020. Brokerages are of a view that the government’s decision is likely to impact the profitability of the sector significantly. Edelweiss Securities, in a note on Monday, said: “The GoI’s recent notification, levying duties on carbon/stainless steel exports, is likely to erode the profitability of the sector significantly. In larger canvas, the move has throttled the recent rise of Indian steel industry in the global arena. While we expect some quantum of exports to sustain as major players would seek to maintain their market share, their cash generation capability is likely to be undermined, resulting in lower RoE.”

[ad_2]

Source link