[ad_1]

MSIL’s Q3 EBITDA fell 30% y-o-y but rose 82% q-o-q (5% above JEFe). Ebitda margin improved 250bps q-o-q after four consecutive quarters of decline. We see better times for MSIL ahead given strong demand recovery, easing chip constraints, input cost pressures behind, and a product cycle likely around the corner. MSIL’s commentary was positive on all the above parameters. Our FY23-24 EPS is 19-30% above consensus. We retain Buy with Rs 10,500 PT (earlier Rs 9,250).

Sequential improvement in Q3: MSIL’s Q3 volumes were down 13% y-o-y but rose 13% q-o-q as chip shortage started to ease. Gross margin improved 50bps q-o-q as price hikes and lower discounts more than offset the incremental input cost pressures. This, along with better operating leverage, drove 250bps q-o-q expansion in Ebitda margin to 6.7% — the first sequential improvement after four consecutive quarters of decline. Ebitda fell 30% y-o-y but rose 82% q-o-q; Ebitda/vehicle was up 61% q-o-q to Rs 36K. Net profit was 2.1x q-o-q (down 48% y-o-y) and was in line with JEFe.

Improving volume outlook: Indian PV demand is recovering well amid the COVID waves, and we expect industry to grow 12%/24%/14% in FY22/FY23/ FY24. MSIL has 264K order book, about 1.5 month of volumes on our FY23 estimate. Industry channel stocks were down to just 8-10 days in Dec. vs normal level of 30-40 days. Chip constraints are easing and MSIL expects Q4 to be better than Q3. Its 9MFY22 exports are ~2.2x of 9MFY20, led by expansion in Africa utilising Toyota’s distribution network, and MSIL believes the improvement is sustainable.

Margins bottomed out: After a sharp year-long rally, steel prices have weakened amid growth and property sector concerns in China; precious metals are also down 18-44% from May 2021 peak. We believe the peak of commodity cost pressures for autos is behind, while continued price hikes and operating leverage benefit should drive better margins ahead. We factor in MSIL’s Ebitda margin expanding to 12% in FY23-24, in line with long-term average.

SUV launches key: MSIL’s retail market share has slipped from 49% in FY21 to 43% in 9MFY22 on weaker SUV presence and chip shortages. While MSIL shares limited details on product pipeline, the company said that its portfolio should strengthen in the coming year, and it has a strong focus on mid-priced SUVs where it has a weaker presence. We have assumed one SUV launch each in 2022 and 2023 in our estimates.

MSIL’s strong CNG focus is a tailwind amid increasing CNG availability and rising petrol prices. New lower-priced SUV launches by competitors, such as Tata Punch, and Tata’s entry into CNG pose risks though.

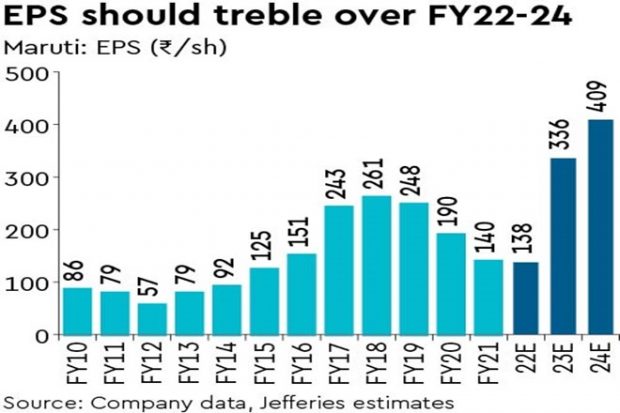

Time to Buy: We cut FY22 EPS by a slight 4% on lower financial income, but we broadly maintain our FY23-24 estimates. We expect volumes to rise 39% over FY22-24, which along with strong margin expansion, should drive more than doubling of Ebitda and trebling of EPS over the next two years. Its 26x FY23e PE is not cheap, but valuations should sustain amid strong volume and earnings outlook. We rate Buy with a Rs 10,500 PT based on 28x Sep-23e PE. On 3-5 year view, MSIL’s electrification strategy would be key for its franchise.

[ad_2]

Source link